Latest on Trump’s Tariffs On Canada and Mexico

- Mandeep Singh, CEO

International trade wars are back in the headlines as former President Trump has announced sweeping tariffs on imports from Canada and Mexico.

These tariffs are not just another political maneuver; they have far-reaching consequences across industries, impacting supply chains, manufacturing costs, and business strategies worldwide.

Latest on the New Canada and Mexico Tariffs

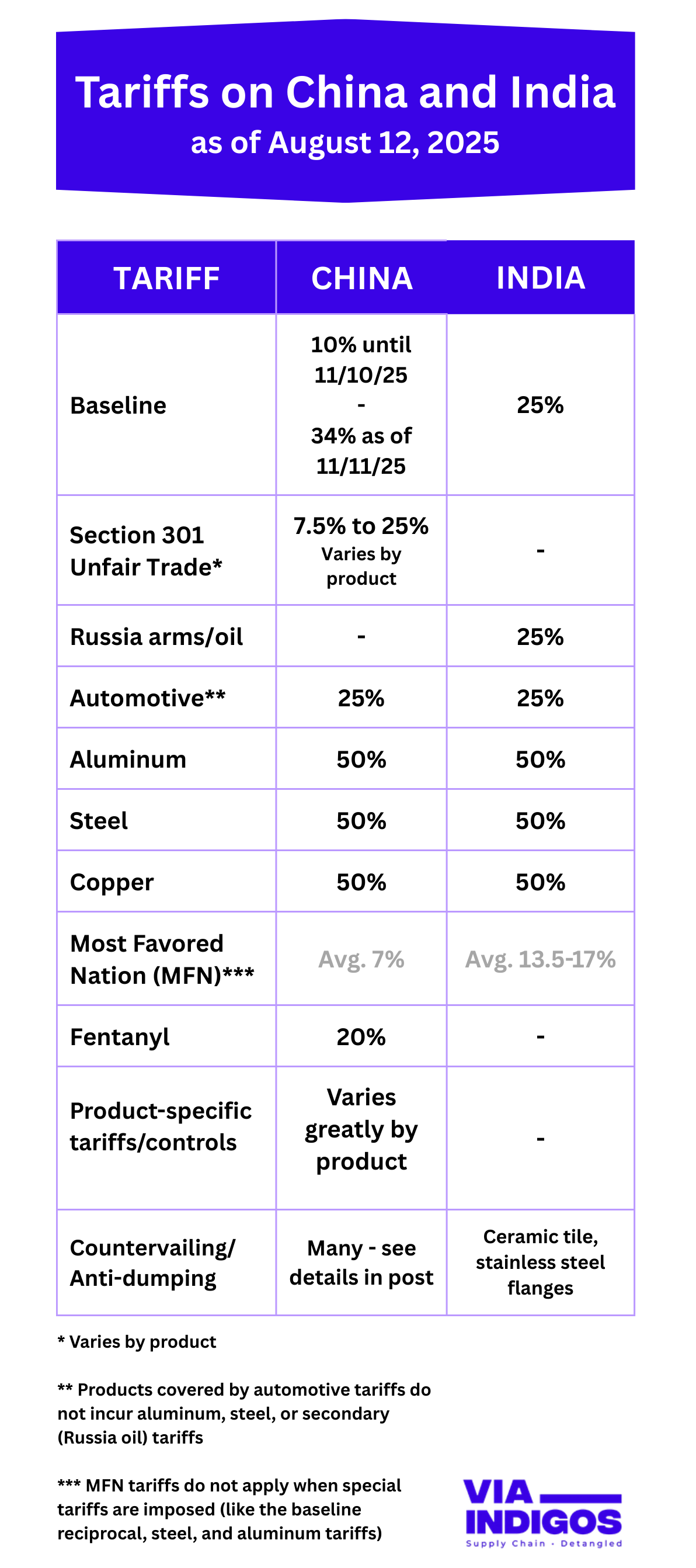

Permission granted to republish the image above with attribution and a link to this content.

IMPORTANT: Tariffs are continually changing and importers should not rely on this information to determine their actual tariff obligations.

Importers get the official costs of tariffs imposed primarily through customs authorities of the importing country, which calculate tariffs based on the Harmonized System (HS) codes of the products being imported.

Aug 6, 2025 Russia oil secondary tariff set at 25%. It does not stack with the automotive tariff.

July 31, 2025 90 day extension of 25% base tariff granted to Mexico.

July 12, 2025 President Trump announced a 30% tariff on Mexico and the EU beginning August 1, 2025.

July 10, 2025 Trump threatened to impose 35% tariffs on Canada, effective August 1, 2025. Peacock Tariff Consulting‘s analysis of the impact on Canada.

July 9, 2025 Trump’s 50% tariff on copper will heavily impact both Canada and Mexico effective August 1, 2025. Details on % of sources and type of copper here.

July 7, 2025 Official White House announcement Extending the Modification of the Reciprocal Tariff Rates.

Additional information from Christine Zhang and Tony Romm can be seen in this NY Times article on Trump’s New Tariff Threats.

July 2, 2025 Vietnam tariff deal at 20%. Chinese transshipments subject to 40% tariffs. Full known details here.

June 11, 2025: President Trump announced a deal has been made with China.

They have agreed to return to the framework previously agreed to in Geneva. Trump said that China will provide rare earth minerals and magnets “up front”.

The U.S. will impose 55% tariffs on China and China’s tariffs on the U.S. will be 10%. Additionally, Chinese students will be permitted to continue in U.S. universities.

However, the agreement still awaits final approval from both President Trump and President Xi.

May 30, 2025: Speaking to U.S. Steel workers, President Trump announced:

May 29, 2025: A federal appeals court temporarily reinstated Trump’s tariffs, granting a stay one day after the trade court blocked them.

The tariffs remain in effect while the appeals process continues.

The U.S. Court of Appeals for the Federal Circuit has ordered responses by June 5 (plaintiffs) and June 9 (government).

May 28, 2025: A U.S. trade court ruled the president overstepped his authority by imposing tariffs, finding that the 1977 International Emergency Economic Powers Act does not grant “unbounded” authority.

Current Tariff Amounts

President Trump’s latest trade policy according to an April 2025 Whitehouse Fact Sheet and other authoritative sources provide this update:

- 0% tariffs on USMCA compliant goods

- 25% “First CAMX Tariffs” on non-USMCA compliant goods (most imports) from Canada and Mexico

- Steel and aluminum tariffs, if applicable, are assessed in addition to the 25% CAMX tariff

- 10% tariffs on Canadian energy products

- 12% tariffs on non-USMCA compliant goods if fentanyl/migration IEEPA orders are terminated

- 10% tariffs on potash from both countries

- The 90 day pause on tariffs for many countries does not apply to Canada or Mexico

While previous tariff policies under his administration focused primarily on China, this time, the impact is more widespread.

See the latest news on China’s tariffs here.

Canada and Mexico, the U.S.’s largest North American trading partners, are facing major import restrictions.

President Trump’s tariffs could help to restore a level playing field for U.S. markets.

He intends for tariffs to to create jobs for American workers and improve the country’s economy.

Mexico responded with praise for receiving “preferential treatment”. They are negotiating with the U.S. regarding the 25% tariff imposed on auto imports.

Meanwhile, Canada has retaliated. Canadian law firm Blakes provides a running timeline of the Canada vs U.S. retaliatory tariff battle that is ongoing.

Both nations are in further discussions on border security, trade agreements, and combating illegal activities in hopes of lowering these tariffs further.

Why Did President Trump Put Tariffs on Mexico and Canada?

The justification for these tariffs is rooted in political and economic concerns:

• Border Security & Immigration: The administration claims that tariffs on Canada and Mexico are necessary to address illegal immigration and drug trafficking.

• Protectionism & Domestic Manufacturing: Similar to past policies, the goal is to bring manufacturing jobs back to the U.S. by making foreign products more expensive.

How Will This Impact Economic Growth in Key Manufacturing Industries?

Automotive Sector

Tariffs have the potential to severely affect economic growth:

The North America auto industry is deeply integrated across the U.S., Canada, and Mexico.

Parts often cross borders multiple times before a final vehicle is assembled.

Higher tariffs mean increased costs for automakers, potentially leading to higher car and light truck prices for consumers.

In particular, the 25% tariff imposed on the components inside of imported automobiles that are not U.S. made could increase the cost of imported vehicles by $5k-$10k.

Tariffs on both imported vehicles and auto parts will increase the cost of insurance.

There is some good news. Thanks to lobbying by automakers and the automotive industry, President Trump has provided some relief:

"Under the new order, imported automobiles will no longer face additional tariffs on aluminum and steel, preventing multiple tariffs from being imposed on the same product. The change is aimed at alleviating the economic pressure on automakers. Also, Trump has adjusted the 25% tariffs on auto parts, which were set to go into effect on May 3. The new plan allows carmakers who produce and sell completed automobiles in the US to claim an offset worth up to 3.75% of the value of a domestically made vehicle. This offset will decrease to 2.5% in one year and be eliminated the following year, in an effort to incentivize domestic manufacturing. This relief will apply to cars produced after April 3."

Ravi Hari, Livemint

Energy & Natural Resources

Sustainable Solutions: Large-Scale Solar Farm Harnessing Renewable Energy for a Sustainable Future

Energy and energy resources from Canada – including crude oil, natural gas, refined petroleum products, uranium, and certain critical minerals – face the 10% tariff unless they meet USMCA compliance.

- The 10% tariff on Canadian energy products directly impacts crude oil and natural gas imports.

- U.S. refiners that rely on Canadian crude may face increased costs, potentially affecting gas prices.

Manufacturing & Industrial Goods

U.S. manufacturers that source components from Mexico and Canada are facing increased costs. They supply many industries besides automotive.

For instance, many parts manufacturers that supply the automotive sector also produce forged, machined, or cast components.

Critical components such as engine and transmission parts, suspension systems, and fasteners are all relevant to the aerospace industry and shipbuilding.

Suppliers specializing in high-precision CNC and VMC tooling, component manufacturing, and metal fabrication often serve many industries, as the processes and quality requirements can be similar.

Electronic components and systems, such as power supplies, wiring harnesses, and control modules, are widely used in vehicles, planes, ships, and machinery.

Automobiles assembled in North America cross the Canada and Mexico borders multiple times. For example, popular Ford trucks and SUVs are assembled in the U.S. with parts sourced from both countries.

A better example is that a single vehicle transmission crosses between the Canadian border, the U.S., and Mexico seven times during assembly!

That is why the government eased tariffs on the industry as explained above. Goods will not be subject to stacked tariffs, particularly on steel and aluminum.

Tariffs on China, Canada, and Mexico will add further pressure on companies that are already dealing with supply chain disruptions.

Agriculture & Food Supply Chains

Canada and Mexico rank among the largest suppliers of agricultural products to the U.S.

The imposition of higher tariffs could result in price hikes for fresh produce and food items, impacting both businesses and consumers.

Manufacturing Challenges in Canada Besides Tariffs

The Canadian Manufacturers & Exporters (CME) documented challenges Canada is facing. They identified labor and skills shortages.

And Canada needs to expand their skilled workforce to modernize. They also need investment to increase digital trade and innovation to fuel growth.

Canada’s manufacturing sector is being required to decarbonize. They have already invested and earmarked $1.02 million which is only a start.

Even if decarbonization is fully funded, Canada will need ever expanding innovation that doesn’t currently exist in the manufacturing industry.

Another Risk: Ongoing and Pending Antidumping Actions

The government agency authority in America that may act against companies suspected of violating international trade agreements is the International Trade Commission (ITC).

Nearly every country has either current actions or pending investigations. So every manufacturer needs to research how these actions may affect their industry or companies.

Antidumping / Countervailing Orders Against China

China has had multiple actions taken, including a limited exclusion order (LEO) barring entry that affects components for injection molding machines related to intellectual property theft of trade secrets.

Recent AD/CVD Orders Against China (2024-2025):

- Active Anode Material – American Active Anode Material Producers filed AD/CVD petitions in December 2024, with claimed dumping margins of 828% and Commerce made a preliminary affirmative countervailing duty determination. SOURCE: Federal Register.

- Tin Mill Products – Final antidumping and countervailing duty determinations were issued in January 2024 for tin mill products from China.

- Low-Speed Personal Transportation Vehicles – AD/CVD investigations were initiated in July 2024 for dumping margins of 379.81% – 478.09%.

Permission granted to republish the image above with attribution and a link to this content.

IMPORTANT: See disclaimer under the first tariff image on this page.

Antidumping / Countervailing Orders Against Canada

Canada has an ongoing antidumping and countervailing duty orders of 12.32% on large diameter welded pipe. This action covers both carbon and alloy steel line pipe and structural pipe.

Permission granted to republish the image above with attribution and a link to this content.

IMPORTANT: See disclaimer under the first tariff image on this page.

Antidumping / Countervailing Orders Against Mexico

Mexico (as well as Thailand and Vietnam) are under investigation for chassis and subassemblies being allegedly sold in the U.S. markets at less than fair value (dumped) and subsidized by the governments of Mexico and Thailand.

ANTIDUMPING DUTIES on Mexico: (Specific Rates Available):

1. Steel Concrete Reinforcing Bar (Current as of May 2024):

- Deacero Group: 1.16%

- Grupo Acerero: 6.21%

- Grupo Simec and others: 2.11%

- All-others rate: 20.58%

2. Heavy Walled Rectangular Welded Carbon Steel Pipes/Tubes:

Active duties (specific rates not immediately available)

3. Standard Steel Welded Wire Mesh:

Active duties (specific rates not immediately available)

COUNTERVAILING DUTIES (CVD):

1. Steel Concrete Reinforcing Bar:

Active CVD order confirmed in continuation (October 2020) Yahoo Finance.

Federal Register confirmed in “Steel Concrete Reinforcing Bar From Mexico: Preliminary Results of Countervailing Duty Administrative Review; 2022-2023; Publication Date: December 2, 2024; Agency: Department of Commerce.

Permission granted to republish the image above with attribution and a link to this content.

IMPORTANT: See disclaimer under the first tariff image on this page.

Supply Chain Diversification is No Longer Optional

For businesses that are already grappling with supply chain issues post-pandemic, these tariffs introduce additional challenges.

In recent years, many businesses have adopted a “China Plus One” strategy to lessen their reliance on China by diversifying production to other countries.

This strategy is now evolving. Companies are beginning to consider a “Mexico Plus One” or “Canada Plus One” approach to mitigate the risks associated with these new tariffs.

But where can they find reliable and cost-effective manufacturing options?

India: The Strongest Alternative for Supply Chain Resilience

India’s manufacturing sector is rapidly growing, positioning the country as a global production hub that offers high-quality manufacturing at competitive prices.

With the U.S. imposing tariffs on three of its largest trading partners, businesses are in search of new sourcing destinations, and India is emerging as a leading alternative:

✔ Skilled labor & advanced capabilities – India provides a wide range of manufacturing services, from casting and forging to injection molding and precision CNC and VMC machining.

✔ Government-backed incentives – Initiatives like “Make in India” and Production-Linked Incentives (PLI) enhance India’s appeal for foreign companies.

✔ Global supply chain integration – India’s developing port infrastructure and logistics network facilitate smooth trade with the U.S.

India's Kerala Port Now Accepts Deepwater Transshipments

India now has the ability to handle deepwater transshipments. On Wednesday, April 9, 2025, Vizhinjam International Seaport in Kerala successfully docked the MSC Turkiye.

MaritimeGateway describes the MSC Turkiye and the event:

"Vizhinjam International Seaport, developed and operated by Adani Ports and SEZ Ltd (APSEZ), today welcomed one of the world’s largest and most eco-friendly container vessels – MSC Turkiye – in a landmark moment for India’s maritime industry. This marks the vessel’s maiden call at an Indian port. Measuring 399.9 metres in length, 61.3 metres in width, and 33.5 metres in depth, MSC Turkiye has a staggering carrying capacity of 24,346 twenty-foot equivalent units (TEUs), making it the largest container ship ever to dock at an Indian port. Its arrival underscores Vizhinjam port’s rising prominence as a global transshipment hub capable of handling ultra-large container vessels (ULCVs). Strategically located just 10 nautical miles (19 km) from the east-west international shipping lane, Vizhinjam boasts a natural depth of 20 metres."

MaritimeGateway

Adani Ports and APSEZ have a 40-year agreement with the Kerala government.

Distribution of goods manufactured in India just became faster and less expensive.

The Production Linked Incentive (PLI) scheme is a perform- ance-based incentive program in India that aims to boost the manufacturing sector.

The scheme offers financial incentives to companies that increase their sales of products made in India.

The PLI initiative is intended to reduce imports and promote domestic manufacturing.

How VIA INDIGOS Helps Businesses Navigate This Shift

At VIA INDIGOS, we recognize that businesses require flexible and scalable solutions to adapt to evolving trade policies.

Our vast network of over 492 production partners across more than 12 industries allows companies to transition their supply chains without sacrificing quality, cost, or efficiency.

With a strong presence in India, we manage everything from selecting suppliers and ensuring quality control to handling logistics and compliance, helping businesses reduce the risks associated with trade volatility. Our expertise covers over 15 manufacturing processes, including:

- Aluminum Extrusion

- Casting & Forging

- Sheet Metal & Fabrication

- Injection Molding & Blow Molding

- Rubber extrusion & Molding

Read a case study on our VIA INDIGOS home page to see actual annual savings we have achieved for manufacturers.

VIA INDIGOS: Comprehensive Supply Chain Support

Supplier identification & qualification – We find trustworthy manufacturing partners with the necessary certifications.

✅ Quality control & compliance – We ensure that every product meets international standards through our rigorous Quality Assurance Process (VIQAP).

✅ Logistics & on-time delivery – With large team on the ground, we manage everything from po to door delivery.

✅ Cost-effective manufacturing across 12+ industries – We cater to sectors ranging from automotive and heavy-duty equipment to electronics and consumer goods.

✅ Diverse manufacturing capabilities – We cover over 15 specialized production processes, including aluminum extrusion, precision machining, and custom tooling solutions.

Conclusion: The Only Constant is Change

Trade policies are subject to change due to shifting geopolitical and economic conditions.

Tariffs may be revised, removed, or expanded based on political and diplomatic developments.

Businesses that hesitate to adapt risk losing their competitive advantage.

However, due to the unpredictable nature of trade policies, it is essential to prepare for long-term stability.

Rather than merely reacting to policy changes, forward-thinking companies are proactively securing their supply chains for the future.

Diversification is not just a strategy for cost savings; it is essential for long-term stability.

At VIA INDIGOS, we assist businesses in navigating these complexities by leveraging India’s manufacturing capabilities.

The question isn’t IF you should adapt—it’s HOW FAST you can move.

With boots on the ground and a vast network of production partners in INDIA, we help you cut tariffs, reduce lead times and avoid supply chain disruptions.